Reports

New Indications for Iran’s Lack of Domestic Uranium Resources for Nuclear Power Purposes ; Plenty for Nuclear Weapons

by David Albright, Sarah Burkhard, Paul Tervo, and the Good ISIS Team

August 19, 2024

Despite having already acquired sufficient uranium to supply a sizable nuclear weapons arsenal, Iran’s domestic uranium resources do not match its nuclear power reactor goals, meaning it cannot have an economically viable, domestic source of uranium to fuel its firmly planned nuclear power reactors, which have multiplied in recent years. The Institute reported in 2009 that the country’s then-operating mines were producing at fractions of the rates needed to support a nuclear power program while its acquired stock from abroad was beginning to be used up. 1 Since then, Iran has come up with multiple ways to increase its uranium supply. Iran has made attempts to expand its domestic production through expanding its existing mines and opening multiple new small mines, and has begun enriching depleted uranium. More troubling, Iran has intensified its efforts to acquire uranium from abroad, contemplating to extract uranium from Syrian-supplied phosphate ore, and negotiating a purchase of yellowcake from Niger, with the first shipment reportedly slated to happen this month. While so far not enough for its ambitious nuclear power reactor plans, the resulting uranium supply is more than enough for a nuclear weapons program. If Iran finalizes a deal with Niger to gain access to a major fraction of one of its large uranium mines, it could import enough uranium for several of its nuclear power reactors (but it still would not have enough conversion and enrichment capacity to convert the uranium into fuel for even one power reactor).

Introduction

Iran’s ambitious nuclear power plans are long standing. Starting in the 1970s, Iran’s atomic establishment operated by the Atomic Energy Organization of Iran (AEOI) discussed building 20 large nuclear power reactors. Each would have a power of about 1000 megawatt-electric (MWe) and need over 8000 tonnes of uranium over a forty-year lifetime, or an average of 200 tonnes per year. 2 Those initial plans have been scaled back in recent years to about eight large power reactors with at least three of them relying on imported uranium fuel from Russia. These three are Bushehr 1 (915 MWe) and Bushehr 2 and 3 (each 974 MWe). 3 Nonetheless, Iran still lacks sufficient domestic uranium resources to provide fuel for the five other power reactors, which include the Darkhovin reactor, aka IR-360 reactor, and Iran’s four more recently announced Strait of Hormuz reactors. 4 Even if Iran obtained this uranium, it lacks sufficient uranium conversion, enrichment, and fuel production capacity to enrich the uranium up to reactor-grade and produce the necessary fuel for these power reactors.

Some references state a somewhat lower uranium requirement for the nuclear power reactors. For example, the OECD Red Book on Uranium resources estimates that Iran’s Bushehr power reactor needs 160 tonnes of uranium per year. 5 This value can be derived by assuming that the 29 tonnes of enriched uranium fuel needed per year has an enrichment level of three percent and a tails assay is 0.2 percent. This value translates into a forty-year uranium requirement of 6400 tonnes for each power reactor, a requirement still formidable in the face of Iran’s ambitions. However, it needs to be taken into consideration that this value is likely outdated since the Bushehr 1 reactor has been using higher enrichment levels in recent years, closer to four percent (see footnote 3).

To try to address its uranium needs in the past, Iran had built two uranium mines. The mine at Saghand can mine in theory about 50 tonnes of uranium per year. 6 The nuclear weapons program built the smaller Gchine mine, later known as the Bandar Abbas Uranium Production Plant, turned over to the AEOI in 2003/2004. 7 This mine was rated in the early 2000s as able to produce a nominal 21 tonnes of uranium per year. 8 However, it was closed in 2016. 9

Both mines have low grade ore and limited total amounts of recoverable uranium. For Saghand, the recoverable uranium is about 860 tonnes of uranium, ignoring inevitable processing losses. 10 At a throughput of 60 tonnes per year, the mine would be exhausted in 14 years of operation. Saghand may have more recoverable uranium, but that extra amount is not likely to more than double the recoverable quantity of uranium. Gchine’s recoverable uranium resources are less, estimated at 84 tonnes. 11

Thus, the recoverable quantities of uranium from these two mines are not nearly enough for one large, 1000 MWe nuclear power reactor, which will require 200 tonnes per year and 8000 tonnes in total.

Given Iran’s shortage of established, domestic uranium resources, it is not surprising that Iran is seeking new uranium sources domestically and abroad.

Opening of small, new mines

Iran has claimed that its uranium deposits are larger than previously assessed, claiming in July 2023 that it had enough ore discovered to open six new mines by May 2024. 12 It is unknown how much uranium is extractable from these new mines. However, given the country’s many surveys conducted since the 1990s, one could doubt that six significant uranium deposits were only just discovered now, and the estimated resources at the first mine opened recently support this conclusion.

Narigan Mine

One example is the Narigan mine, which Iran opened in central Iran in 2023 and which appears operational or near-operational as of May 2024. 13 The location is near the village of Narigan, about 35 kilometers (km) from the city of Bafq and about 90 km south of Iran’s main operating uranium mine at Saghand. According to Iran, it has 650 tonnes of recoverable uranium; there is no information on Narigan in the OECD redbook as of 2022. 14 Ore from this mine is likely shipped to the uranium mill at Ardakan. The 650 tonnes of uranium said to exist are not a large amount for a nuclear power reactor program, but a considerable amount for a nuclear weapons program. It is enough uranium for over 50 weapons, using about 10 tonnes of natural uranium for each quantity to account for inefficiencies.

For comparison, as discussed above, it is only about eight percent of the uranium needed for one 1000 MWe power reactor or enough uranium to provide fuel for about three years for one Bushehr-sized reactor.

As of May 2024, significant levels of activity can be seen at Narigan, including ore sorting and a truck scale with possible radiometry, which is necessary for correctly sorting uranium ore based on the amount of uranium in each measured batch. Figure 1 provides satellite images showing the changes at the site since May 2022 and the mine reaching operational status.

Figure 1. Changes at the Narigan mine from May 2022 (top) to May 2024 (bottom). The mine appears operational as of May 2024. 31°43’16”N, 55°41’23”E.

Jang-e Sar Mine

Another example is the Jang-e Sar mine, where Iran broke ground in August 2023. 15 The complex is in the country’s West Azerbaijan province around 15 km from the Turkish border. Iran has not released any estimates on the amount of uranium ore in the mine, and it is not included in the 2022 OECD Red Book either. Iranian Atomic Energy Chief Mohammad Eslami claimed it would be a “significant” source of fuel for reaching the energy program’s 20,000 MWe reactor goal, 16 but it is unclear what that means, and he likely would claim the same for Narigan. 17 Construction of the mine is estimated to take 30 months from the ground breaking, projecting a date around March 2026 for completion. At the time, Iran did not provide the exact location, but the AEOI published a ground photo, which could be correlated with a Google Earth terrain perspective (see Figure 2).

Satellite imagery at the location shows initial ground scraping and a small mining operations support camp as early as 2021; since the 2023 announcement, minor preparatory activity has taken place. As of July 2024, continued ground scraping, prospect scarring, and new support buildings are visible at the site (see Figure 3). The presence of two probable dragline excavators are an indication that mining operations could begin soon.

Figure 2. The ground perspective in an AEOI photo showing buff colored ground, grayish, rocky outcrops, and a path on the side of the mountain matches the terrain at a location in the immediate vicinity of Jang-e Sar in northwest Iran.

Figure 3. The location of the Jang-e Sar mine shows preparatory activity happening between May 2021 (top) to July 2024 (bottom), but no observable mining.

Expansion of Saghand

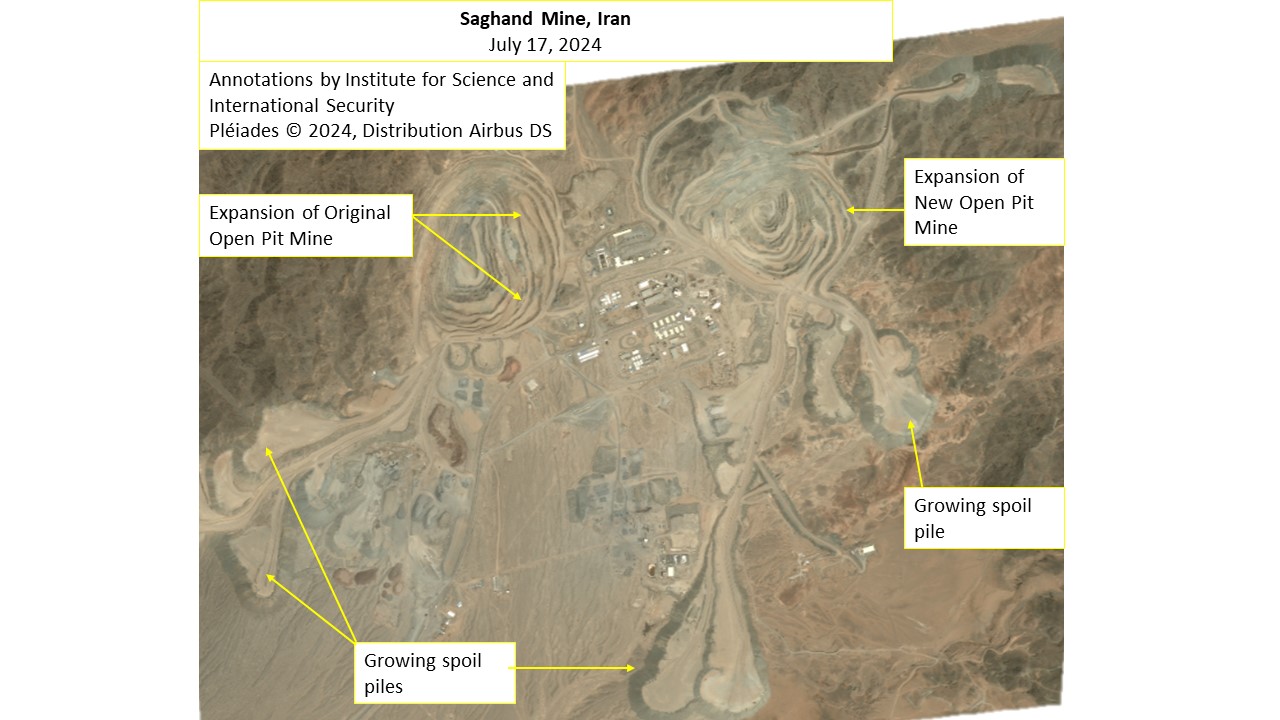

Iran also expanded operations at the Saghand mine, creating a new open pit mine in 2022 and expanding the two open pit mines since then. 18 Figure 4 shows the expansion. This new pit, however, is directly above the area where previous underground mining operations had taken place via a vertical shaft and horizontal tunnels, meaning that it would be unlikely to contain as much uranium as a new pit elsewhere. 19 Further, figure 5 shows the majority of the area’s uranium is located deep underground; if Iran exhausted its underground mining, the new surface mine is unlikely to be able to add much.

Observations from available satellite imagery emphasize the limited impact of this new pit mine. In 2020, the area leading to the new pit was largely undeveloped. By 2022, at the time of excavating the open pit, a series of new support buildings had been added, as well as a truck scale with possible radiometry. By September 2023, however, many of these buildings had been removed and the truck scale had already been moved closer and next to the security checkpoint at the entrance/exit of the mine. Truck activity also had greatly decreased. This seems to show that the purpose of the mine might have been a limited effort to recover a few near-surface deposits of uranium that might not have been accessible by the deeper underground mining operations. In this case, there would be little additional mining to be undertaken once the deposits were excavated.

Figure 4. The Saghand mine underwent notable expansion in the last years; first, a new open pit mine was added, then, both open pit mines were expanded. Top: Saghand in 2022; bottom: Saghand in July 2024.

Figure 5. Cross-section of Saghand mine showing depth of notable ore deposits. 20

Deal with Niger

In late April this year, the French newspaper Africa Intelligence (A.I.) reported that Iran was negotiating with Niger an apparently one-time purchase of 300 tonnes of uranium oxide, also known as yellowcake or uranium ore concentrate, worth $56 million. 21 Other sources indicate that negotiations had been completed by February. 22 The 300 tonnes of uranium oxide would contain about 255 tones of uranium. Using the numbers above, this would be enough for roughly 30 nuclear weapons or sufficient for a little more than one year of fuel for one Bushehr-sized reactor.

In the months since the initial deal for the one-time purchase was reported, it has also been reported that Iran is interested in mining in Niger, and Niger appears to be open to it; Niger’s military government has been revoking uranium mining licenses from Western corporations and has begun receiving suitors from Russia, China, and Iran, with rumors circulating that the latter is actively searching for permits. 23 Niger’s newly available deposits include the massive deposit at Imouraren, estimated to contain 200,000 tonnes of uranium, making Iran’s interest in mine acquisition more concerning. Turkey additionally has been seeking uranium from the country. 24 If Iran received permission to mine one-fifth of the deposits, i.e. getting 40,000 tonnes of uranium, it could be enough uranium to fuel five nuclear power reactors for forty years, however, it is unlikely that Niger would give up such a large fraction to one buyer. Further, this calculation ignores losses in processes and the fact that Iran does not have anywhere near the required uranium conversion and enrichment capacity to utilize this amount of natural uranium.

A.I. reported that 50 tonnes of yellowcake would be delivered to Iran by August, meaning that the initial part of the deal has been or will be completed soon. In exchange, Niger would reportedly receive Iranian arms including air defense missiles and tactical drones.

This is not the first time that Iran has turned to Africa to acquire uranium for its nuclear program. Iran first purchased 450 tonnes of uranium from South Africa in the mid-1970s as its program was getting started. 25

Possible Extraction of Uranium from Copper-Nickel-Cobalt Mining

In 2016, it was reported that Iran’s copper-nickel-cobalt-uranium mine near Anarak, Iran, known as the Meskani mine, which was considered fully mined-out, had been reopened following the construction of a new ore processing plant in the area. 26 The uranium contents in the ore had led the AEOI to investigate the mine in 2007 as a potential source for radioactive material. 27 Thus, the AEOI was aware of the site’s uranium-producing capabilities but had chosen to pass on it in 2007.

The reopening of the mine, but especially the features of the new ore processing facility, raise the likelihood that Iran has, since 2016, been extracting some uranium from the reopened Meskani mine as a byproduct of the production of copper. The decision to bring the mine out of retirement could therefore be an instance of barrel-scraping by nuclear officials reevaluating old sources that had previously been thought inefficient.

Extraction of Uranium from Phosphates

An Iran International report from May 2023 revealed that Iran planned to import 800,000 tonnes of phosphate from a mine under the Islamic Republic’s control in Syria to extract uranium. 28 Phosphates, while typically used for fertilizers, are also an uncommon source for small amounts of uranium. However, its sale is not regulated the same way as conventional uranium sources are. It is unknown at what rate usable uranium could be extracted from this ore. Eslami claimed it to be very “high grade.” 29 Typical phosphate deposits contain approximately 0.02 percent uranium, meaning that this shipment could have 160 tonnes of uranium, enough for 16 nuclear weapons but not enough for a year for a reactor. 30

Iran may also be exploring extracting uranium from phosphate ore discovered several years ago at the Sheikh Habil mine. 31 However, little information is available about this potential, albeit small source of uranium.

Enriching Depleted Uranium

It is difficult to estimate how much natural uranium Iran still has in uranium hexafluoride form from previous conversion at Esfahan, as well as how much uranium hexafluoride Iran is currently producing at Esfahan. However, one indication that Iran may be running low on natural uranium hexafluoride is that the IAEA reported that Iran has begun using some of its installed centrifuge capacity at the Pilot Fuel Enrichment Plant at Natanz to enrich depleted uranium to natural uranium. 32 Unfortunately, the IAEA is not expected to report periodically on how much natural uranium hexafluoride was produced.

Lack of Transparency

Uranium mining and ore processing at mills are not required to be reported or safeguarded under comprehensive safeguards agreements (CSAs). However, under the CSA, Iran is required to report imports of uranium ore concentrates, in particular any yellowcake, to the IAEA, and any other material containing uranium that has not reached the stage of the fuel cycle, including phosphates, if it is imported for a nuclear purpose.

The loophole in the CSA on mining and milling is rectified by the Model Additional Protocol (AP). With an AP in force, the country has to specify the location, the operational status and the estimated annual production capacity of uranium mines and concentration plants, i.e. mills, and the current annual production of such mines and mills as a whole. Further, the IAEA could request the current annual production of an individual mine or concentration plant.

One of the accomplishments of the JCPOA was that it provided the IAEA with access to Iran’s known uranium mine, Saghand, and to Iran’s uranium mill, Ardakan. 33 The country was also obligated to report its stockpile of both domestically produced and externally acquired yellowcake and place those stocks under IAEA monitoring and verification. This way, the IAEA was able to monitor yellowcake flow to the Esfahan uranium conversion facility. 34 It is unclear, however, whether or not the IAEA has ever visited the reopened Meskani copper-nickel-cobalt mine or the associated new ore concentration plant under the terms of the JCPOA, where Iran may be extracting uranium as a byproduct.

Due to its violations of the JCPOA, including the termination of implementing the Additional Protocol, Iran has not reported amounts of uranium mined or milled for several years and the IAEA has not been able to verify or monitor the amount of uranium ore concentrate produced in Iran or obtained from any other source; and whether such uranium ore concentrate has been transferred to the conversion facility at Esfahan.

Contacted by Africa Intelligence at the time of the initial article, the IAEA confirmed that they had not been alerted of the deal with Niger. However, Iran would still be bound by its reporting requirements under the CSA if it imported uranium ore concentrate.

Additionally, Niger, which has both CSA and AP in force, would be required to report exports of yellowcake and mining operations to the IAEA.

1. David Albright, Jacqueline Shire, Paul Brannan, “Is Iran Running Out of Yellowcake?” Institute for Science and International Security, February 11, 2009, https://isis-online.org/uploads/isis-reports/documents/Iran_Yellowcake_11Feb2009.pdf.</a ↩

2. This value assumes an annual fuel loading of 29 tonnes of enriched uranium per year, based on industry data from several years ago, and an enrichment level of 3.7 percent, leading to an average for about 200 tonnes of uranium per year, where additionally a tails assay of 0.2 percent is used during the enrichment process. The enrichment level is likely to increase, reflecting nuclear industry efforts to achieve higher fuel burnups. See also footnote 3. ↩

3. Each year, as of several years ago, Bushehr 1 required on average about 29 tonnes of enriched uranium fuel per year, based on nuclear industry data. Based on internal Bushehr documents, the enrichment level was about 4.0 percent with a planned burnup of almost 50,000 MWt-days/tonneU. At a tails assay of 0.2 percent, this amount of enriched uranium would require about 215 tonnes of natural uranium (U mass), or 8600 tonnes of uranium over a forty-year reactor lifetime. If Iran were to enrich the uranium and provide the fuel for other power reactors, its enrichment plants may require a higher tails assay, requiring more uranium feed to achieve a fixed enrichment level. ↩

4. David Rogers, “Iran Starts $15bn Nuclear Power Plant on the Strait of Hormuz,” Global Construction Review, July 7, 2024, https://www.globalconstructionreview.com/iran-starts-15bn-nuclear-power-plant-on-strait-of-hormuz/. ↩

5. “Uranium 2022: Resources, Production and Demand,” Organization for Economic Co-Operation and Development, May 11, 2023, https://doi.org/10.1787/2c4e111b-en. p. 314. ↩

6. IAEA Director General, Implementation of the NPT Safeguards Agreement in the Islamic Republic of Iran, GOV/2004/83, November 15, 2004. Paragraph 4, https://www.iaea.org/sites/default/files/documents/gov2004-83.pdf. ↩

7. David Albright with Sarah Burkhard and the Good ISIS Team, Iran’s Perilous Pursuit of Nuclear Weapons (Washington, DC: Institute for Science and International Security Press, 2021), Chapter 8. ↩

8. Implementation of the NPT Safeguards Agreement in the Islamic Republic of Iran, November 15, 2004. Par. 4. ↩

9. IAEA, Country Nuclear Power Profiles 2022 Edition, Iran, Islamic Republic of Iran, https://www-pub.iaea.org/MTCD/Publications/PDF/cnpp2022/countryprofiles/IranIslamicRepublicof/IranIslamicRepublicof.htm See also, “Iran Breaks Ground for New Uranium Mine,” World Nuclear News, August 15, 2023, https://world-nuclear-news.org/Articles/Iran-breaks-ground-for-new-uranium-mine. ↩

10. 1.55 million tonnes of uranium ore, with 553 ppm, or 0.000553 percent uranium. Source: AEOI. Franz J. Dahlkamp’s 2009 book Uranium Deposits of the World suggests 1400 tonnes, allowing a lifespan of just over 22 years. ↩

11. “Uranium 2020: Resources, Production and Demand,” Organization for Economic Co-Operation and Development, 2020, https://www.oecd-nea.org/jcms/pl_52718/uranium-2020-resources-production-and-demand ↩

12. “Iran to run 6 more uranium mines as reserves greater than estimated: AEOI chief,” Press TV, July 23, 2023, https://www.presstv.ir/Detail/2023/07/24/707633/Iran%E2%80%99s-uranium-reserves-much-higher-than-expected,-AEOI-will-run-six-more-mines-by-year-end–AEOI-chief-. ↩

13. Tweet by @TheGoodISIS, “NEW: We have identified the likely location of Iran’s new Narigan mine at 31.72379, 55.68888. The location is near the village of Narigan & consistent with the reported 35 km distance from Bafq. It is also 90 km south of Iran’s only currently operating uranium mine at Saghand. 1/,” X/Twitter, February 13, 2023, 3:39 PM. https://x.com/TheGoodISIS/status/1625233160878301185. ↩

14. “Iran Announces Start-up of Uranium Mine,” World Nuclear News, February 7, 2023, https://www.world-nuclear-news.org/Articles/Iran-announces-start-up-of-uranium-mine. ↩

15. “Iran Breaks Ground for New Uranium Mine,” World Nuclear News, August 15, 2023,https://world-nuclear-news.org/Articles/Iran-breaks-ground-for-new-uranium-mine. ↩

16. “Iran Breaks Ground for New Uranium Mine.” ↩

17.“Iran announces start-up of uranium mine.” ↩

18. Tweet by @TheGoodISIS: “In the meantime, the mine at Saghand is expanding. This June 2022 Google Earth image shows a large new open pit mine being excavated, first visible in Google Earth in January 2022 imagery, in addition to the original open pit mine (~ 2012). 5/,” X/Twitter, February 13, 2023, https://x.com/TheGoodISIS/status/1625234235840688141. ↩

19. Tweet by @TheGoodISIS: “The newer open pit is directly above the area being mined underground based on known ore body mapping published by Iran. 6/,” X/Twitter, February 13, 2023,https://x.com/TheGoodISIS/status/1625234359719452678. ↩

20. Source: Judith Perera, “Iran’s Nuclear Industry,” November 2005. ↩

21. Pierre-Elie de Rohan Chabot, Paul Deutschmann, “Washington Watches as Tehran Negotiates with Niamey for 300 Tonnes of Uranium,” Africa Intelligence, April 30, 2024, https://www.africaintelligence.com/west-africa/2024/04/30/washington-watches-as-tehran-negotiates-with-niamey-for-300-tonnes-of-uranium,110221410-ge0. ↩

22. “Iran’s Uranium Deal With Niger: a US-Iran Face-Off in a New Arena,” Rasanah International Institute for Iranian Studies, March 31, 2024, https://rasanah-iiis.org/english/monitoring-and-translation/reports/irans-uranium-deal-with-niger-a-us-iran-face-off-in-a-new-arena/. ↩

23. Linda van Tilburg, “Iran’s Bid for Nigerien Uranium Mining License Triggers Nuclear Fears,” National Security News, June 27, 2024, https://nationalsecuritynews.com/2024/06/irans-bid-for-nigerien-uranium-mining-licence-triggers-nuclear-fears/. ↩

24. “Turkey Seeks Uranium Supplies from Niger,” North Africa Post, July 22, 2024, https://northafricapost.com/78916-turkey-seeks-uranium-supplies-from-niger.html. ↩

25. “Is Iran running out of yellowcake?” ↩

26. Frank Pabian, Guido Renda, Giacomo Cojazzi, “Open Source Analysis in support to the identification of possible undeclared nuclear activities in a State,” Esarda Bulletin, no. 57, December 2018, p. 30., https://esarda.jrc.ec.europa.eu/system/files/2022-07/Bulletin%2057_2018.8.pdf. ↩

27. “Open Source Analysis in support to the identification of possible undeclared nuclear activities in a State.” p. 36 ↩

28. “Exclusive: Iran Importing Phosphates from Syria to Extract Uranium,” Iran International, May 3, 2023,https://www.iranintl.com/en/202305034278. ↩

29. “Exclusive: Iran Importing Phosphates from Syria to Extract Uranium.” ↩

30. “Uranium from Phosphates,” World Nuclear Association, May 16, 2024,https://world-nuclear.org/information-library/nuclear-fuel-cycle/uranium-resources/uranium-from-phosphates#:~:text=When%20phosphate%20rock%20is%20treated,be%20treated%20to%20recover%20uranium.t ↩

31.https://civilica.com/doc/1385845/. ↩

32. Tweet by @laurnorman, “So what’s the gist of the Iran report from @iaeaorg. More or less what we said. 1/ Iran is adding feeding depleted uranium at its research facility (PFEP) to 60 centrifuges to produce very low enriched uranium. (Up to 2%) -1-,” X/Twitter, June 13, 2024, 1:56 PM, https://x.com/laurnorman/status/1801312767963550017. ↩

33. “IAEA Investigations of Iran’s Nuclear Activities,” Arms Control Association, https://www.armscontrol.org/factsheets/iaea-investigations-irans-nuclear-activities. ↩

34. “Joint Comprehensive Plan of Action: Annex 1,” 2009-2017 State Department, p. 21., https://2009-2017.state.gov/documents/organization/245318.pdf. ↩

twitter

twitter