Reports

Chinese Export of Restricted High Priority Battlefield Items to Russia

by Spencer Faragasso

September 23, 2024

The Institute for Science and International Security has reviewed more than 295,000 commercial import-export trade manifest records from May 2022 through the end of December 2023, detailing exports of restricted Tier One Harmonized System Codes (HS Codes) items on the Bureau of Industry and Security (BIS) Common High Priority List (CHPL) being exported by Chinese companies to Russian importers. The BIS CHLP applies trade restrictions to Russia on the most sensitive and sought-after Western electronics and other commodities that Russia requires to build its war machine. Tier One covers key items that Russia cannot domestically produce and that have limited manufacturers and constitutes four HS Code chapter 84 codes (8542.31, 8542.32, 8542.33, and 8542.39) detailing the most important electronics which Russia needs to build drones, missiles, and other weapon systems. Russia depends on illicit import practices and networks to acquire these goods from overseas, mainly Western goods via China. Without these critical commodities, Russia would be crippled in its ability to produce the advanced missiles, drones, and other combat systems it needs to wage its war of aggression in Ukraine.

More than $1.5 billion worth of restricted Tier One commodities were found being exported from China to Russia during the assessed period. The shipments contained electronics designed and produced by Western firms, but shipped by often obscure and little-known Chinese companies to Russian firms. Shipments containing Western brands found in the trade data include Texas Instruments, XILINX, Analog Devices, Intel, NVIDIA, ST Microelectronics, and other major sought-after designers and producers of electronics. Many of these companies’ products have been frequently found in Russian weapons used in Ukraine, especially in drone systems such as the Shahed 136 and the Lancet kamikaze drones, and Kometa anti-jamming equipment. For example, XILINX field programmable gate arrays (FPGA) and microcontrollers, all of which were found in the assessed trade data, are essential components in the Shahed 136, hundreds of which are being launched at Ukraine each month. 1 NVIDIA Jetson AI modules play a key role in how the Lancet—another drone launched by Russia at Ukraine in the thousands—autonomously identifies, tracks, and engages targets. 2 These amounts of drones, as well as other weapon systems like missiles and other drones, demand a huge quantity of Western Tier 1 goods to keep up production rates and meet the Russian military’s operational needs.

Analysis of Russian Importing Companies

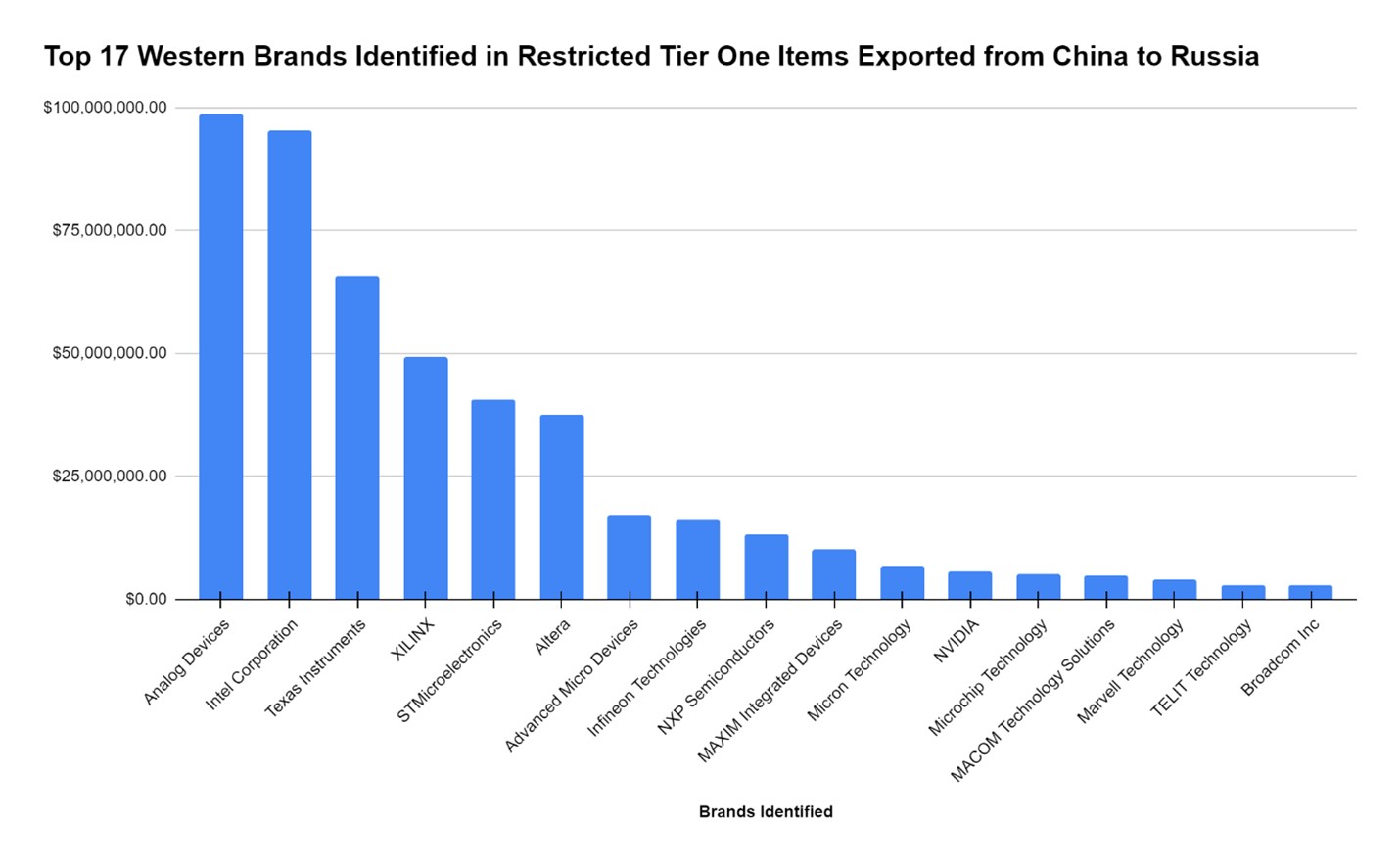

The top fifty Russian importers were analyzed, accounting for more than $677 million worth of imports out of the total import value of $1,501,290,000. The top 50 companies imported numerous types of electronics, described in the data’s product descriptions as including integrated monolithic circuits, field programmable gate arrays (FPGA), computer CPUs, microcircuit amplifiers, graphics processing units (GPU), NVIDIA Jetson Orin AI modules, and other electronics. For the overall trade data, the top 17 Western brands accounted for nearly $476 million worth of goods (see Figure 1).

An analysis comparing the sanctioned Russian companies importing restricted goods to those not sanctioned shows that Western sanctions have only scratched the surface of the illicit activity. Far more companies importing restricted electronics go unsanctioned and avoid direct legal scrutiny than those that do face sanctions. Fifteen of the top 50 Russian importers are sanctioned entities, fourteen by the United States and one only by Ukraine. Comparing the import value of the sanctioned Russian companies to the non-sanctioned Russian companies reveals the extent to which sanctions on individuals, addresses, and companies can do only so much to halt the flow of high priority sensitive goods (see Figure 2). The sanctioned Russian companies imported more than $218 million worth of restricted Tier One commodities from Chinese companies, accounting for roughly 15 percent of the total import value. Total imports rose sharply in late 2023 to $125 million, the largest value in the assessed period. The available data ended on January 1, 2024, but there is no reason to believe that imports declined or discontinued after this date.

One sanctioned Russian company, LLC SMT-AILOGIK (tax identification number: 7804552300), for example, imported several million dollars’ worth of XILINX brand monolith integrated circuits with built-in field programmable gate arrays. Despite LLC SMT-AILOGIK being sanctioned by the United States on May 19, 2023, the company conducted more than $5 million worth of business between June and October 2023. 3 LLC MODERN DIGITAL TECHNOLOGIES (tax identification number: 1655424901), sanctioned by the United States in April 2023, imported more than $4.2 million worth of Texas Instruments, XILINX, and Analog Devices electronics. The company conducted the majority of its business, more than $16 million worth of imports, after being sanctioned. Another sanctioned company, Joint Stock Company VNIIR Progress was sanctioned on November 2, 2023, for the supply, development, and production of electronic components for the Russian Armed Forces, but yet continued to import more than $2.5 million worth of restricted electronics from Chinese companies. 4 VNIIR Progress makes the Kometa anti-jamming module found in Russian drones, guided bombs, and missiles, a module making it unexpectedly difficult for Ukraine to jam the weapon and render it harmless.

So far, sanctions have not achieved the hoped-for effect, as hundreds of millions of dollars’ worth of goods continue to flow between Russia and China. Of the 15 sanctioned companies, seven continued to conduct business with Chinese firms after being sanctioned by the United States or Ukraine, importing more than a total of $35 million of restricted Tier One items. Only two Russian importers ceased importing restricted goods after being sanctioned by the United States. Six Russian importers were sanctioned after the term covered by the trade data. The six companies sanctioned in 2024 imported more than $65 million of Tier One commodities between 2022 and the end of 2023. Even when the sanctioning process is applied, it is slow, and illicit actors can conduct business for a long period of time without scrutiny.

Figure 1. The top 17 Western brands identified in the Tier One exports from China to Russia.

Figure 2. The total import value of the top 50 Russian imports broken down by sanctioned and non-sanctioned companies from May 2022 to the end of 2023.

Conclusion

This analysis shows that the supply of controlled microelectronics to Russia steadily increased in 2023, and that China was a major source of the Tier 1 goods, despite Western restrictions and pressure. Aided importantly by China, Russia has countered the sanctions imposed by the United States and its allies. As a result, the state of sanctions on Russia and the restriction of high priority goods require further development to increase their effectiveness.

While Western governments could do more, they have been responsive with tighter restrictions. 5 On the other hand, Western semiconductor companies have failed to hold up their responsibilities and in particular their obligation not to undermine those restrictions. In a companion article, the Institute calls on Western electronics companies to do far more to ensure that their goods do not continue helping to arm Russia in its bloody attacks on Ukraine. 6 To incentivize this industry, the companion report also calls for the U.S. government to start fining specific semiconductor companies that are exporting goods that make their way to Russia, even if inadvertent. There is more than sufficient evidence to do so in the downed drones and missiles in Ukraine.

1. See for example, “Russian Company Elmak Procures ‘High Priority’ Items for Russia’s War Efforts via China,” by David Albright and Spencer Faragasso, Institute for Science and International Security, July 11, 2024, https://isis-online.org/isis-reports/detail/russian-company-elmak-procures-high-priority-items-for-russias-war-efforts/8. ↩

2. Spencer Faragasso, “Russian Lancet-3 Kamikaze Drone Filled with Foreign Parts: Western Parts Enable Russian Lancet-3 Drone to Have Advanced Targeting and Anti-jamming Capabilities,” Institute for Science and International Security, December 18, 2023, https://isis-online.org/isis-reports/detail/russian-lancet-3-kamikaze-drone-filled-with-foreign-parts/. ↩

3. “Russia-related Designations; Issuance of Amended Russia-related Directive 4, Russia-related General Licenses; Publication of Russia-related Determinations; and New and Amended Frequently Asked Questions,” Office of Foreign Asset Controls, May 19, 2023, https://ofac.treasury.gov/recent-actions/20230519. ↩

4. “Treasury Hardens Sanctions With 130 New Russian Evasion and Military-Industrial Targets,” United States Department of Treasury, November 2, 2023, https://home.treasury.gov/news/press-releases/jy1871. ↩

5. See for example the August 23, 2024 BIS notice at https://www.bis.gov/press-release/commerce-tightens-export-controls-targets-illicit-procurement-networks-supplying. ↩

6. David Albright and Spencer Faragasso, “Action from Semiconductor Companies is Long Overdue,” Institute for Science and International Security, September 23, 2024, https://isis-online.org/isis-reports/detail/action-from-semiconductor-companies-is-long-overdue/. ↩

twitter

twitter